Fast, secure, and effortless payments.

PayCircus simplifies payment processing with flexible programs and trusted platforms built to support your industry, operations, and growth.

we make it simple

About PayCircus

Smart Solutions for a Complex Industry

Choosing the right Software Platform, POS Platform, and Card Payment platform shouldn’t feel like a three-ring circus. At PayCircus, we simplify the process (by vetting which platform is best for your business).

Whether you're a low-risk or high-risk merchant, we provide the technology, tools, and support you need to operate, and run your business efficiently, securely, an minimize transaction fees.

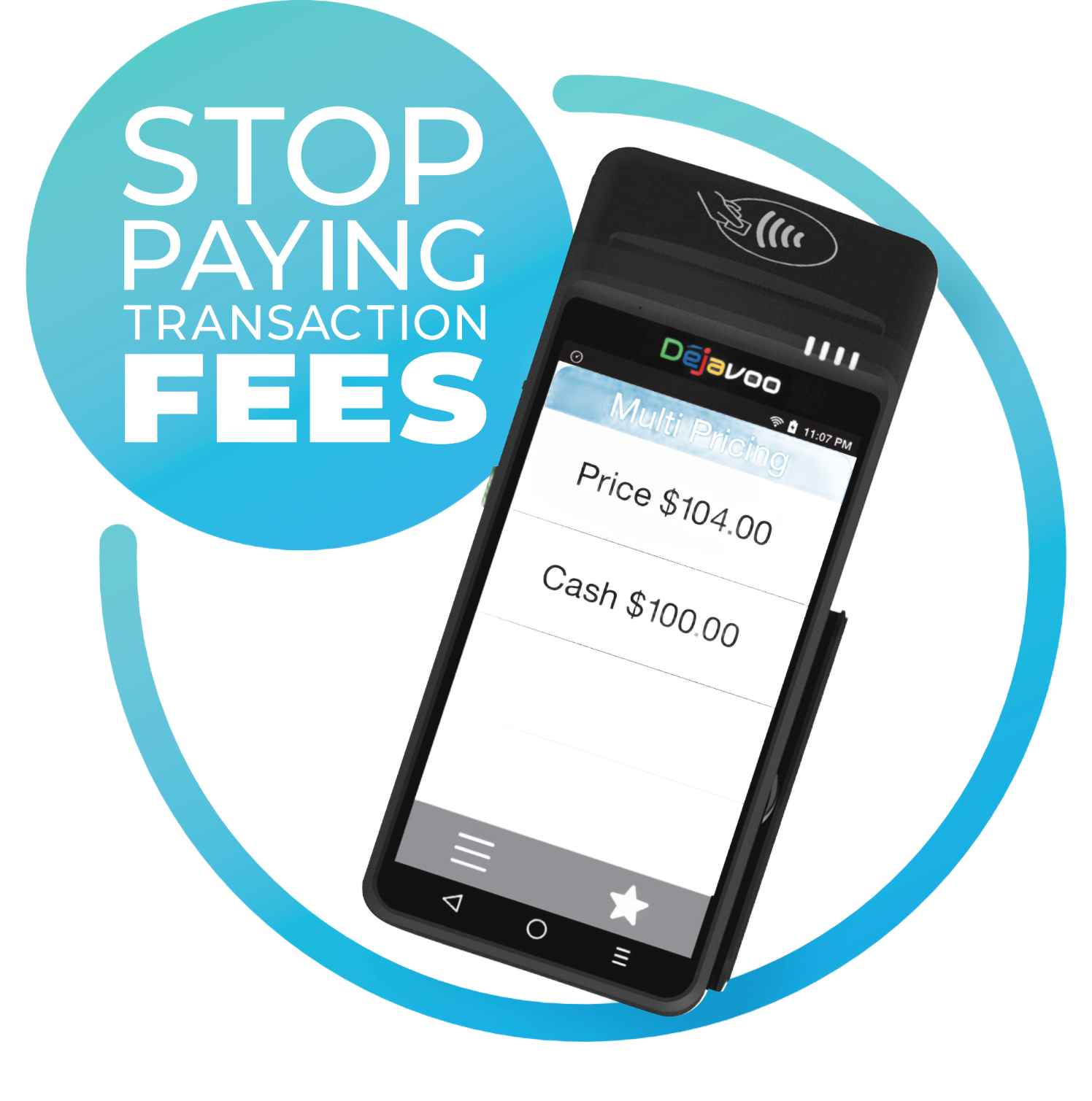

Transaction Fee Options

At PayCircus we review with you the different fee structures to help select which one is best for your business.

Interchange Plus – Merchant pays all bank network transaction fees, these fees are concealed from customers, the fees fluctuate every month depending on the card types.

Fixed Rate – A locked in Flat Rate fee, concealed from customers, that is much higher than Interchange Plus.

Cash Discounting – Transparent pricing discloses to the customer what the transaction fees are. Reward cash paying customer with a price discount.

The next- generation payment method.

SecurePay's mobile application provides a seamless and secure platform for the next generation of payments.

It's time to feel the ease in your financial management. Join other happy users

450k+

Total active users

600k+

App downloads

4.9 Positive reviews

Industries We Serve

Tailored Software Platforms With Integrated Payments for Every Type of Business

PayCircus works with a wide range of industries, delivering industry specific software with integrated payments to run your business efficiently and to maximize profitability. From retail to service-based businesses, we help you improve operations, accept payments, increase sales, and cut costs.

Restaurants

Full Service, Quick Service, get all the features you want at a fraction of the price

Bars & Nightclubs

Sell more product, cut labor, Accept Industry Rebates, and Auto tab close

Software with Integrated Payments

Boost profits and streamline transactions with embedded payments

Restaurants

Full Service, Quick Service, get all the features you want at a fraction of the price

Bars & Nightclubs

Sell more product, cut labor, Accept Industry Rebates, and Auto tab close

Software with Integrated Payments

Boost profits and streamline transactions with embedded payments

Your Feedback Helps Us Grow

We're proud to support businesses across a wide range of industries, from retail and restaurants to fitness centers and service providers. As we continue to grow, we’d love to hear from you.

If PayCircus has helped simplify your payment processing or improve your operations, we invite you to share your experience.

What Our Clients Are Saying

Get in Touch

Let’s talk about the right integrated software payment platform for your business.

Whether you're ready to get started or just have questions, we're here to help. Reach out and a member of our team will follow up with personalized support and guidance tailored to your business needs.

Contact Us

We will get back to you as soon as possible.

Please try again later.